McDonald’s on Friday reported July sales results that were much worse than analysts had expected.

Following the report, the company’s shares traded lower. (Click here for the latest quote.)

The fast-food giant reported global same-store sales fell 2.5 percent, compared with the 1.1 percent drop forecast by Consensus Metrix.

The dismal results prompted Janney Capital Markets to lower its estimates for the fast-food giant. Its analysts said the results “were the worst worldwide month in the last 10 years, once trading-day adjustments are taken into account.”

In the Asia/Pacific, Middle East, and Africa region, sales were down 7.3 percent in the month, where a drop of just 0.5 percent had been expected.

Same-store sales in the U.S. sank 3.2 percent, weaker than the 2.6 percent expected.

RBC Capital Markets analysts blamed the poor U.S. sales on a lack of new items.

“We believe McDonald’s U.S. is focusing hard on operations as a way to bolster growth during peak hours and set the table for future innovation. That said, sales are suffering in the interim with the lack of significant new product news and unsuccessful promotional activity…” analysts wrote in a note.

RBC does not anticipate a large sales boost in the near-term from mobile payments and loyalty programs, although it remains a big opportunity, analysts said.

In Europe, the company’s only bright spot, sales rose 0.5 percent, compared to expectations of a 0.7 percent drop.

Last month, McDonald’s said full-year comparable-store sales were expected to be relatively flat in light of a stagnant informal eating out category, competition, consumer price sensitivity and cost pressure.

“However, as a result of the China supplier issue, the Company’s global comparable sales forecast for 2014 is now at risk,” McDonald’s wrote in the release.

Photographer Finds Locations Of 1960s Postcards To See How They Look Today, And The Difference Is Unbelievable

Photographer Finds Locations Of 1960s Postcards To See How They Look Today, And The Difference Is Unbelievable  Hij zet 3 IKEA kastjes tegen elkaar aan en maakt dit voor zijn vrouw…Wat een gaaf resultaat!!

Hij zet 3 IKEA kastjes tegen elkaar aan en maakt dit voor zijn vrouw…Wat een gaaf resultaat!!  Scientists Discover 512-Year-Old Shark, Which Would Be The Oldest Living Vertebrate On The Planet

Scientists Discover 512-Year-Old Shark, Which Would Be The Oldest Living Vertebrate On The Planet  Hus til salg er kun 22 kvadratmeter – men vent til du ser det indvendigt

Hus til salg er kun 22 kvadratmeter – men vent til du ser det indvendigt  Superknepet – så blir snuskiga ugnsformen som ny igen!

Superknepet – så blir snuskiga ugnsformen som ny igen!  Meteorite That Recently Fell in Somalia Turns Out to Contain Two Minerals Never Before Seen on Earth

Meteorite That Recently Fell in Somalia Turns Out to Contain Two Minerals Never Before Seen on Earth  Nearly Frozen Waves Captured On Camera By Nantucket Photographer

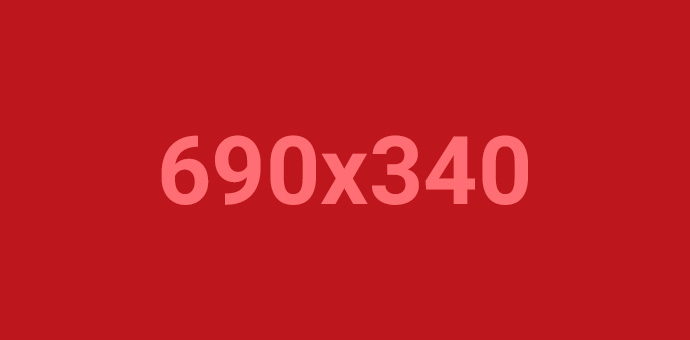

Nearly Frozen Waves Captured On Camera By Nantucket Photographer  It’s Official: Astronomers Have Discovered another Earth

It’s Official: Astronomers Have Discovered another Earth

djvvn9

ycf9e1